Enterprise Strategy

Reaching Our Full Potential

Reaching Our Full Potential

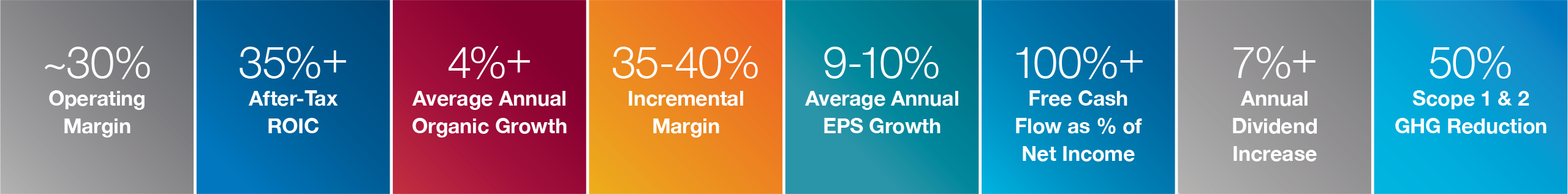

Delivering solid growth with best-in-class margins and returns.

Through the execution of our Enterprise Strategy, the ITW Business Model has proven its power and competitive advantage in the industrial arena.

When the Enterprise Strategy launched in 2012, our stated goals were to deliver solid growth with best-in-class margins and returns. From 2012 through 2023, we made significant progress toward achieving these goals, increasing operating margin over nine percentage points and delivering strong after-tax return on invested capital. We more than tripled our earnings per share and market capitalization and increased our dividends per share by 3.7 times. And importantly, ITW delivered significant shareholder value with a compound annual total shareholder return, outperforming both the S&P 500 and our peer group.

In the Next Phase of our Enterprise Strategy, which began in 2024, organic growth is our highest priority. By 2030, we will build organic growth into a core ITW strength on par with our best-in-class financial performance and operational proficiency.

ITW’s Customer-Back Innovation process is the most impactful driver in achieving organic growth and guides how we deliver value to our customers. We innovate from the customer back, not the R&D center out. Throughout our Next Phase, we will build our Customer-Back Innovation capability with the same rigor and application that we used to significantly improve our 80/20 Front-to-Back capability that underpinned our best-in-class performance over the past decade.

Our continued advancement of ITW’s Enterprise Strategy and differentiated long-term performance also relies on our continued ability to attract, develop and retain Great ITW Leaders and talent. We aspire to be a great employer for all ITW colleagues. We empower our people to think and act like business owner, and the ITW Business Model gives them the tools to focus on what’s most important.